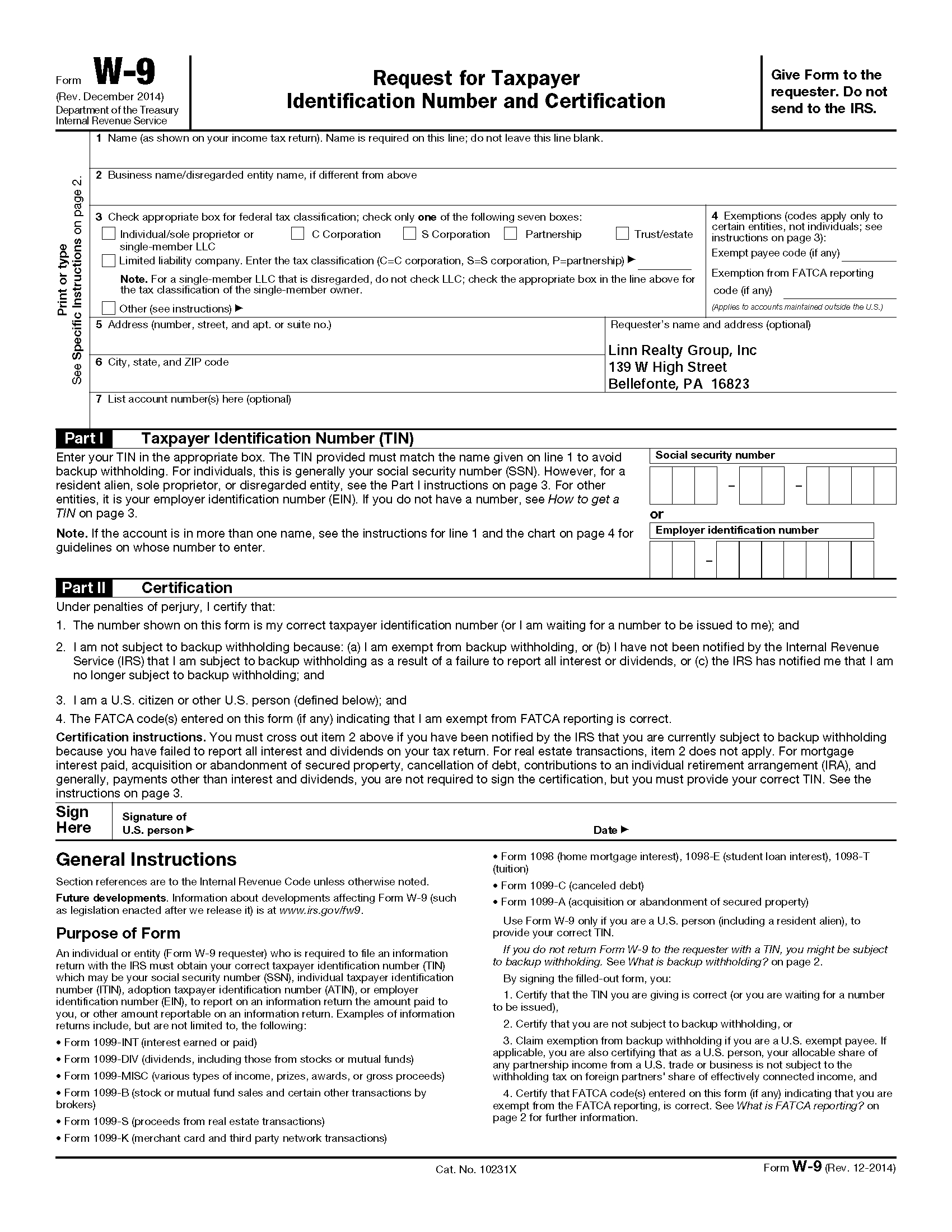

When it comes to filling out important forms, such as the W-9 form, it’s crucial to have the necessary information at your fingertips. The W-9 form, also known as the Request for Taxpayer Identification Number and Certification, is a document that individuals or businesses use to provide their taxpayer identification number to the requesting party, typically the payer for tax purposes.

Filling Out the W-9 Form

One of the crucial elements of filling out the W-9 form correctly is ensuring that all personal information is accurately provided. This includes your name, business name (if applicable), address, taxpayer identification number (such as your Social Security Number or Employer Identification Number), and any other required information.

One of the crucial elements of filling out the W-9 form correctly is ensuring that all personal information is accurately provided. This includes your name, business name (if applicable), address, taxpayer identification number (such as your Social Security Number or Employer Identification Number), and any other required information.

It is important to note that the W-9 form is not submitted to the Internal Revenue Service (IRS), but rather serves as a record of your information for the payer who may need it for tax reporting purposes. Therefore, it is crucial to ensure that the information provided is correct.

Online Options for Filling Out the W-9 Form

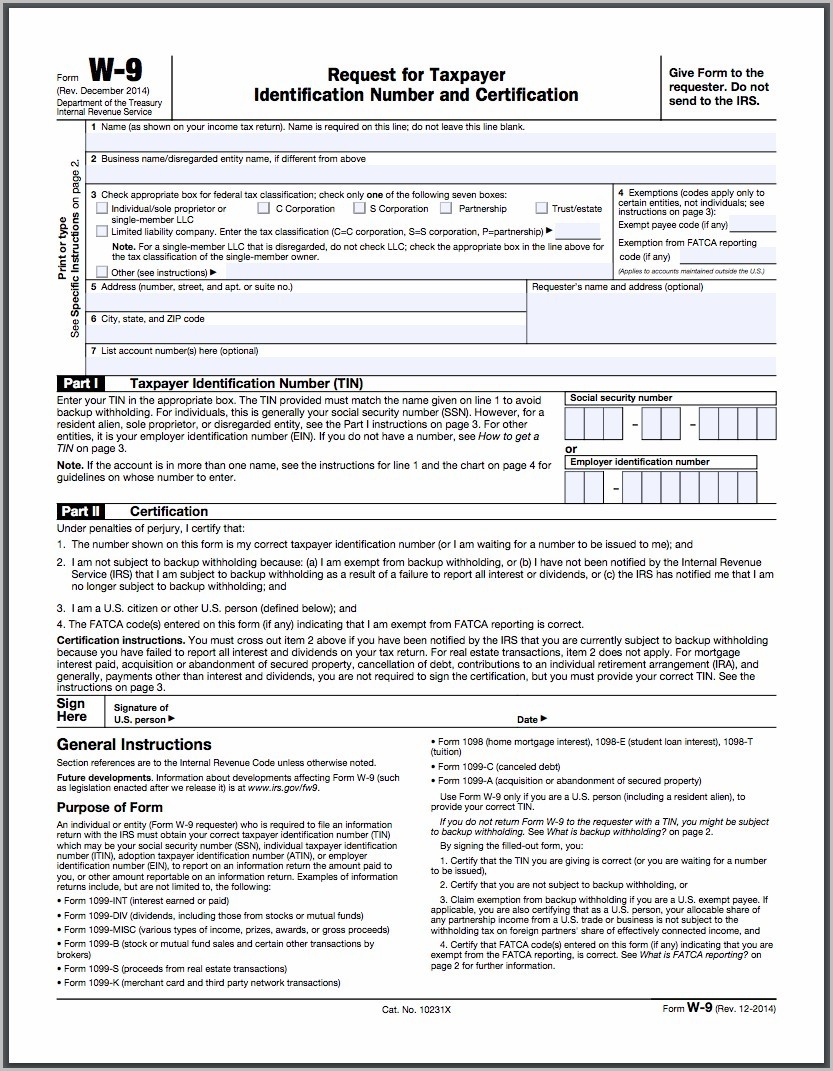

With advancements in technology, it has become more convenient to fill out the W-9 form online. Many websites offer fillable and printable versions of the W-9 form, allowing you to enter the necessary information directly on the digital document. This not only saves time but also reduces the chances of making errors.

With advancements in technology, it has become more convenient to fill out the W-9 form online. Many websites offer fillable and printable versions of the W-9 form, allowing you to enter the necessary information directly on the digital document. This not only saves time but also reduces the chances of making errors.

One such website is HelloSign, which provides a user-friendly interface for filling out the W-9 form online. It allows you to input the required information and then sign the form electronically. Once completed, you can download a copy for your records and share it with the requesting party.

Printable W-9 Forms for Future Use

While filling out the W-9 form online is convenient, it can also be helpful to have printable versions available for future use. Printable W-9 forms can be handy if you prefer to fill them out manually or if you need to provide multiple copies to different payers.

While filling out the W-9 form online is convenient, it can also be helpful to have printable versions available for future use. Printable W-9 forms can be handy if you prefer to fill them out manually or if you need to provide multiple copies to different payers.

Various websites offer printable W-9 forms in PDF format. Simply download and print the form, and then fill it out following the provided instructions. It’s important to have a printer and a pen handy when opting for this method.

Understanding the Importance of the W-9 Form

The W-9 form plays a vital role in ensuring accurate tax reporting. It allows the payer to have the necessary information to complete the IRS Form 1099, which reports payments made to individuals or businesses. By providing your taxpayer identification number, you help the payer avoid penalties for failure to furnish correct payee statements.

The W-9 form plays a vital role in ensuring accurate tax reporting. It allows the payer to have the necessary information to complete the IRS Form 1099, which reports payments made to individuals or businesses. By providing your taxpayer identification number, you help the payer avoid penalties for failure to furnish correct payee statements.

Additionally, the W-9 form serves as a means of verifying the taxpayer identification number with the IRS. The payer can cross-reference the information provided on the W-9 form with the records maintained by the IRS to ensure accuracy and compliance with tax regulations.

Obtaining a Copy of the W-9 Form

If you need to obtain a copy of the W-9 form, you can visit the official IRS website at irs.gov. The IRS provides a variety of resources, including the PDF version of the W-9 form. You can download, print, and fill it out using the instructions provided by the IRS.

If you need to obtain a copy of the W-9 form, you can visit the official IRS website at irs.gov. The IRS provides a variety of resources, including the PDF version of the W-9 form. You can download, print, and fill it out using the instructions provided by the IRS.

It’s crucial to ensure that you are filling out the most up-to-date version of the W-9 form. The IRS periodically updates the form, so always check for the latest revision date to ensure compliance.

Final Thoughts

The W-9 form is an essential document for individuals and businesses when it comes to tax reporting. Whether you choose to fill it out online or by hand, accuracy and attention to detail are crucial to ensure the proper reporting of your taxpayer identification number. Additionally, keeping printable versions of the form handy for future use can save time and effort.

Remember to consult with a tax professional or visit the IRS website for any specific questions or concerns regarding the W-9 form and its proper completion. By doing so, you can ensure compliance with tax regulations and ease any potential stress associated with tax reporting.