If you’re in need of a loan and want to understand how the payments will be structured, an amortization schedule can be incredibly helpful. It gives you a detailed breakdown of each payment, showing how much of it goes towards the principal and how much goes towards interest. This way, you can plan your budget and make informed decisions.

What is an Amortization Schedule?

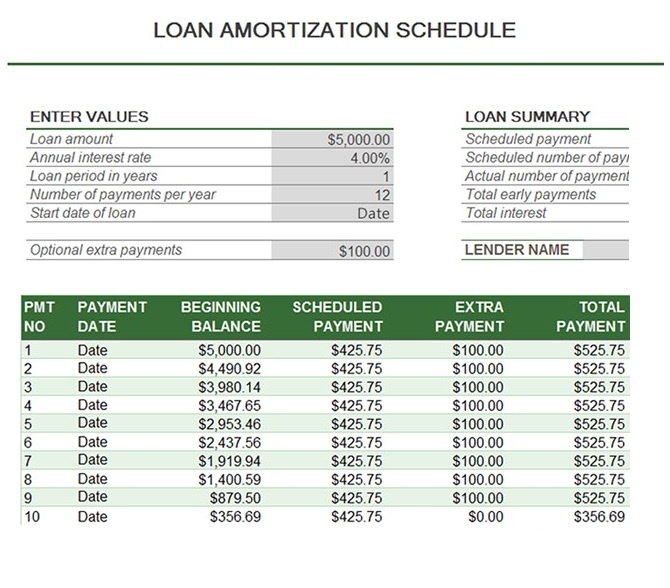

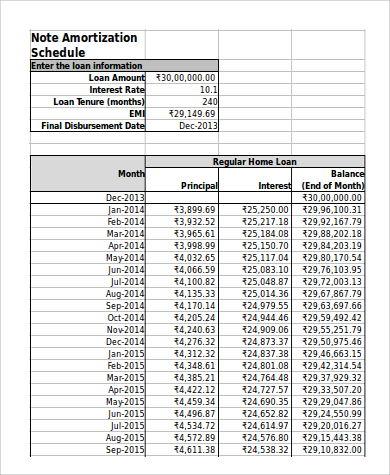

An amortization schedule is a useful tool that shows a complete repayment plan for a loan, including the amount of each payment and how it will be allocated between interest and principal. It allows borrowers to understand how their loan will be paid off over time and how much total interest they will pay.

An amortization schedule is a useful tool that shows a complete repayment plan for a loan, including the amount of each payment and how it will be allocated between interest and principal. It allows borrowers to understand how their loan will be paid off over time and how much total interest they will pay.

With an amortization schedule, you’ll be able to track each payment made and see the reduction in outstanding balance over time. This allows you to have a clear understanding of your financial commitments and make informed decisions about your loan.

Why Use an Amortization Schedule?

Using an amortization schedule can be beneficial for several reasons:

Using an amortization schedule can be beneficial for several reasons:

1. Budget Planning:

By having a clear understanding of when and how much you need to pay each month, you can plan your budget accordingly. This helps you ensure that you have enough funds to meet your financial obligations and avoid late payment penalties or defaulting on your loan.

2. Interest Calculation:

An amortization schedule allows you to see exactly how much interest you are paying in each payment and over the life of the loan. This information can be valuable when comparing loan options or considering early repayment to save on interest expenses.

3. Debt Management:

With an amortization schedule, you can easily monitor the progress of your loan repayment. This helps you stay motivated and focused on paying down your debt. It also allows you to plan and track the impact of making additional payments or paying off the loan early.

How to Use an Amortization Schedule?

Using an amortization schedule is simple:

Using an amortization schedule is simple:

Step 1: Gather Loan Details

Collect all the necessary information about your loan, including the principal amount, interest rate, loan term, and any additional fees.

Step 2: Input Loan Details

Enter the loan details into an amortization schedule tool, such as a spreadsheet or an online calculator. These tools will automatically calculate the monthly payment amount and generate the amortization schedule.

Step 3: Analyze the Schedule

Review the amortization schedule to understand the payment breakdown, interest paid, and outstanding balance at any given point in time. This will give you a clear picture of your repayment journey.

Step 4: Plan your Finances

Use the information from the amortization schedule to plan your monthly budget and ensure you can comfortably afford the loan payments. You can also use the schedule to explore different payment scenarios and assess how extra payments or early repayment could affect your loan.

Conclusion

Whether you’re obtaining a mortgage, car loan, or any other type of installment loan, an amortization schedule is an essential tool that helps you understand the payment structure and manage your finances effectively. By providing a detailed breakdown of each payment, an amortization schedule empowers you to make informed decisions about your loan and plan your budget accordingly.

Whether you’re obtaining a mortgage, car loan, or any other type of installment loan, an amortization schedule is an essential tool that helps you understand the payment structure and manage your finances effectively. By providing a detailed breakdown of each payment, an amortization schedule empowers you to make informed decisions about your loan and plan your budget accordingly.

By using an amortization schedule, you can track your progress, anticipate future payments, and explore different repayment scenarios. With this valuable information, you can take control of your debt and work towards financial freedom.

Remember, an amortization schedule is your roadmap to successfully repaying your loan, so make sure to utilize this tool to its fullest potential.